Meditation, mindfulness and mental health apps

I think we can all agree that employee stress and anxiety levels are pretty high right now. A global pandemic triggers a health crisis matched in magnitude only by the resulting economic slowdown. Fear of job loss and personal safety, especially for those still on the job at essential businesses. Concern for the health of family and friends both near and far. Frustration with restricted travel/movement. Feeling isolated due to mandatory work-from-home orders. Oh, and let's not forget the employee-parents, who are now running day care and homeschools while working remotely.

Many of our clients offer employee assistance programs (EAPs), which can be a great resource for employees to talk with licensed counselors by phone or video. We previously posted about tele-health (including mental health) options through all of the California medical carriers.

But what other resources can employers help their employees tap into? Our Allpointe team put together a shortlist of some popular, app-based solutions. This is not an exhaustive list, and we are not affiliated with any of these companies, but thought they are worth checking out. Many of them offer free or trial versions, group discounts, or employer-paid packages. Let us know if there are others we should add to the list!

Meditation/mindfulness

Guided meditations, mindful breathing, sleep help, movement programs

Asynchronous therapy

24/7 remote access to licensed therapists via web, app and phone

Improving access to therapy

Matching algorithms help you find the right -- and available -- therapist for you

CA Carrier FAQs: Common COVID-19 questions

--

--

--

Our team has been tracking the California health carrier responses to the COVID-19 health crisis. See our earlier post here. Our general agency partners at Warner Pacific have been diligently reaching out to the carriers with follow up questions, and recording the answers as they come in. Here is the 3/30/2020 summary of FAQs with the carrier responses to questions such as:

- Will you offer any additional leniency/grace period to pay premiums?

- Can I pay premium with a credit card?

- Can employees who have dropped to part-time or furloughed status remain on the plan?

- Can we postpone or extend our open enrollment?

- If employees are rehired, can the normal waiting period be waived?

- Is there a special enrollment period allowed now for employees who previously waived?

- Ae tele-health fees waived?

We will post updated versions of the FAQ responses here as new information comes in.

A small business COVID-19 lifeline: CARES Act

The CARES Act offers real immediate assistance to small businesses struggling with the uncertainties generated by the ongoing health and economic crises due to COVID-19. Discuss this with your own tax and legal advisors. I have provided a number of links below that I have found useful in my own research.

TL;DR - There is a extraordinary small business lifeline in the CARES Act, specifically the Paycheck Protection Program, which can turn a guaranteed small business loan into a tax-free grant equal to approximately 8 weeks worth of business operating expenses.

We have spent the last couple of weeks dissecting the effects of the Families First Coronavirus Response Act (FFCRA) on small businesses that are grappling with a shocking loss of business due to the COVID-19 pandemic. Layoffs, furloughs, reductions in hours -- and their resulting effect on employee benefits -- all of these small business survival responses demanded immediate attention as business owners scrambled to simultaneously protect their businesses, their families, and their employees.

Following the signing of the CARES Act on Friday, I believe the next two weeks are going to focus on small businesses accessing a massive cash infusion designed to bring employees back up to full-time pay, at least through the end of June (even if unable to full-time work due to shelter-in-place restrictions).

For businesses that use the loans to ensure employees keep their jobs and returned to full pay (including the rehire of laid-off employees, where applicable), can have the portion of the loan that is equal to 8 weeks of certain business operating expenses forgiven (not required to repay). Specific operating expenses include:

- Payroll (with caps at $100K+ annual comp, and not including payroll taxes)

- Rent, mortgage interest, utilities

- Group health insurance benefits

In addition, small businesses that are suffering a 50% or more loss in revenue vs. the prior year (calculated by calendar quarter) may be eligible for up to $5,000 per employee payroll tax credit. These tax credits are separate from the payroll tax credits offered under the FFCRA's emergency sick leave and FMLA benefits. It is our understanding that businesses cannot benefit from this tax credit and the Paycheck Protection Program.

In short, while the FFCRA was designed to provide immediate sick leave and family protection for employees, the CARES Act is designed to keep American businesses going through the end of June.

Below is a collection of the most helpful resources I have found. I recommend you review and discuss with your tax and legal advisers as soon as possible.

Best overviews of CARES Act:

U.S. Chamber of Commerce Small Business Guide and Checklist

U.S. Senate Committee on Small Business & Entrepreneurship

Immediate analysis from national law firms:

Littler

Gibson Dunn (specific focus on the Paycheck Protection SBA loan program)

Skadden (a little more dense/detail than the other links)

Third party analysis:

Forbes - Peter J. Reilly - Paycheck Protection Program

I hope you find this helpful, and I am happy to discuss any of this with you, and in particular what it means for your ability to retain employees and to continue their employee benefits.

CARES Act restores OTC medications as eligible expenses

The CARES Act, signed into law Friday, March 27, 2020 restores over-the-counter medications as eligible expenses for Health Savings Accounts (HSA), Flexible Spending Accounts (FSA) and Health Reimbursement Arrangements (HRA), without a prescription, retroactive to January 1, 2020.

The law also incorporated several, healthcare related tax benefits:

- Menstrual care products added as eligible expenses for these qualified accounts

- Allows tele-health to be covered at no cost on HSA-compatible HDHP plans, through December 31, 2021

- The IRS has also ruled the elimination of cost-sharing for COVID-19 related treatment does not disqualify HDHP medical plans from HSA-qualified status

More details here from our partners at Discovery Benefits. And a great summary analysis of the CARES Act from SHRM, here.

Accessing health care from home: tele-health options

There are probably a dozen good reasons to check out your medical plan's tele-health options right now, but at the top of my list would be avoiding an in-person visit to a medical facility (to protect yourself and others) and reducing the overall strain on the health care system and providers.

And yet, we all need care -- including (or especially) mental health care. All of our CA group medical plans include options for tele-health visits. Even if you don't need this right now, consider checking out your carrier's resources (and registering or downloading the app, where needed) so that you are prepared to access care if you do need it.

In response to the COVID-19 pandemic, some carriers have begun to waive tele-health fees (Aetna, Blue Shield so far). Otherwise, tele-health visits and care are generally subject to normal plan office visit and/or Rx copays. We have compiled links and helpful documents here, and will continue to add more.

24/7 Nurseline for telephone consultation (all carriers - call number on back of medical ID card)

Aetna

- What is Telemedicine?

- Set up your Aetna Teladoc account

Anthem Blue Cross of CA

- LiveHealth Online registration and access

- LiveHealth Online psychology/chat therapy services

Blue Shield of CA (access from Blue Shield online account)

- Teladoc services (need to access from within Blue Shield online account)

Cigna (access from mycigna.com online account or app)

Kaiser

- (new: March, 2020 - free for Kaiser members) myStrength digital health app for mental health and well-being

- E-visits, video visits, email your doctor and more

- Mental health (no referral needed)

Oscar

Sutter Health Plus

United Healthcare (set up your myuhc.com account first)

Western Health Advantage

Health Carrier Responses to COVID-19

On March 5, Governor Newsom directed California health insurance carriers to waive all patient costs related to testing for COVID-19 (novel coronavirus). This includes medically necessary lab tests and associated clinic, emergency room, and/or medical staff fees. Notably, it generally does not waive costs for subsequent treatment, in the event of a positive test. In general, treatment will be covered under the normal rules and structure of the patient's health plan.

Carriers we know to have reached out directly to employer clients and covered individuals, between March 5th and March 9th:

- Cigna (employer notice sent): Coronavirus resources and updates

- Anthem Blue Cross (sent employees email/text on 3/8/20): What you need to know

- Blue Shield of CA (sent employees email 3/5-3/6/20): News Center - waiving cost-sharing and prior authorization

- Kaiser Permanente (employer and employee notices sent): COVID-19 update

We have not yet seen specific communications from United Healthcare, Aetna or Health Net. However, Aetna and Health Net have posted confirmation that copays/cost-sharing is waived for medically necessary services related to COVID-19 testing:

- Aetna: What you need to know

- Health Net: Assisting members

United Healthcare surprisingly does not yet appear to have complied with the Governor's direction.

This is an excellent time to remind employees that all employer-provided health plans include one or more versions of tele-health services, from 24x7 nurse lines to video visits. These can be excellent options to help deal with other minor health issues, to get necessary care and prescriptions, without having to physically visit a doctor's office or medical facility. If you or your team are unsure of how to access the tele-health options included in your plan, please reach out to your Allpointe benefits support team.

We encourage all of our clients and employees to follow the CDC guidelines with respect to preventive measures in the workplace, at home, and for travel.

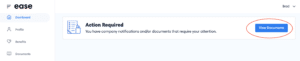

Viewing a new company benefits document in Ease

Throughout the year, various benefits-related documents may get updated, or become newly available. Important documents requiring review or signature from the employee, will be posted along with an email notification from Ease. The next time the employee logs in to their Ease portal, the required action is clear, and the first thing they will see:

Employees are not able to complete any other benefits-related actions, including annual open enrollment, new hire enrollment, qualifying events, or other changes until the required review has been completed.

For small employers, this is an easy, streamlined way to maintain benefits compliance.

For employees, necessary documents are easily viewed at any time, from any computer, tablet or smartphone, and the documents remain available for future detailed review at the employee's convenience.

Cigna/Dignity Health Contract Ends January 1st

Cigna and Dignity Health (Common Spirit Health) continue to negotiate a renewal, while their current contract ended January 1, 2020. This means Dignity Health providers in California and Nevada are no longer in-network for Cigna's Open Access Plus (OAP) plans. There are some temporary continuation of coverage accommodations for patients in active treatment for certain health conditions. Notable Dignity Health providers in the San Francisco Bay Area:

- St. Francis hospital (San Francisco)

- St. Mary's hospital (San Francisco)

- Sequoia hospital (Redwood City)

- GoHealth urgent care (multiple locations)

Read more:

There are no guarantees, but historically we have seen repeated patterns where insurance carriers and large health systems know that they ultimately need each other, and will eventually resolve contractual differences. Putting patients in limbo -- with minimal notification -- in our opinion, is reprehensible. We would encourage employers and patients who are affected and motivated, to consider making themselves heard by speaking out: to Cigna, to Dignity Health, and to your elected representatives.

Counting Employees to Determine COBRA Status

We were "right around 20" employees this past year.

Most employers are well aware that there is a 20-employee threshold determining whether their group health plan is subject to federal COBRA or to state continuation coverage, such as Cal-COBRA. Far fewer employers are certain of exactly how to count to 20. And no wonder: the federal government alone requires multiple counting methodologies to determine ACA compliance, COBRA, Medicare as Secondary Payer (MSP), and FMLA, just to name a few.

California and the City of San Francisco also have laws and ordinances which require employee counts, adding even more complexity to that spreadsheet file you just exported from payroll. Apply the same methodology to determine employee counts for all of these, and an employer is certain to either a) spend time and money voluntarily complying with a non-requirement; or b) put their organization at risk by failing to comply with a local, state or federal requirement. Either scenario can be costly.

Is it really that big of a deal?

In general, COBRA requires group health plans to provide continuation coverage to employees, former employees, and their eligible dependents. Messing up someone's access to continued access to health insurance is not something that goes unnoticed. Think about some of the common reasons people qualify for continuation coverage under COBRA:

Loss of employment. Divorce or legal separation. Reduction in work hours. Death of the covered employee. Serious, stressful stuff. So, let's get this right.

OK, is my group health plan subject to COBRA?

COBRA generally applies to all private-sector group health plans maintained by employers that had at least 20 employees on more than 50 percent of its typical business days in the previous calendar year. Both full- and part-time employees are counted to determine whether a plan is subject to COBRA.

- AN EMPLOYER’S GUIDE TO GROUP HEALTH CONTINUATION COVERAGE UNDER COBRA (US Dept of Labor)

Got it. So, we have 15 full-time employees and 10 part-time employees. I guess we need a COBRA administrator.

Well, maybe. But maybe not. Reading a little bit further:

Each part-time employee counts as a fraction of a full-time employee, with the fraction equal to the number of hours worked divided by the hours an employee must work to be considered full time. For example, if full-time employees at Company A work 40 hours per week, a part-time employee who works 20 hours per week counts as half of a full-time employee, and a part-time worker who works 16 hours per week counts as four-tenths of a full-time employee.

My calculator is smoking. Where can I get more detailed information?

The Dept of Labor's Employer's Guide to Group Health Continuation Coverage Under COBRA is a good start. Need additional help? Reach out to our Allpointe benefits support team.

I can use this same counting method to determine whether our plan or Medicare is primary...right?

Yeah, about that...close, but not exactly. Stay tuned...

Still struggling with paper enrollment forms? Let's automate.

Some small employers are still struggling with spreadsheets, paper and .pdfs for their employee benefits. But why? Check out our Ease benefits portal, customized for your small business and your team:

https://youtu.be/U1UUsBLkukY

Our experienced team will customize a benefits portal that builds your plan details, rates, eligibility rules and change requirements into simplified workflows, that can work alongside any payroll system or software. Full 360 and 180 integrations are also available with popular payroll platforms, such as Paylocity, ADP, Heartland, and more.

Contact Allpointe today to learn more about bringing your benefits and onboarding processes securely into the cloud.

Preparing to travel outside of Kaiser's service area?

Maybe you are headed for a 6-week dream vacation on another continent (lucky you). Meeting friends for a spur of the moment trip to Manhattan? Or dreading tomorrow's 7-hour drive to spend Thanksgiving with your in-laws in Arizona. Wherever your travels are taking you, at some point you pause and ask yourself,

"Does Kaiser cover me if something happens while I'm away from home?"

Then you realize you aren't 100% sure. You think so, but don't know exactly who to call or how to access services. Sound familiar?

Glad you asked.

Yes, you are covered for emergency and urgent care anywhere in world.

And if you happen to be traveling to another part of the U.S. where Kaiser is located, such as the Pacific Northwest, Hawaii, mid-Atlantic states, or Colorado, you can also access more routine services. Check out Kaiser's Care While Traveling page for the Away from Home Travel Line number, links to the secure messaging app, and more useful information.

Always refer to your plan's Evidence of Coverage and related documents for details of your specific coverage.

You can now pay your Covered CA small business invoice online

Will we get enrollment and eligibility management next?

When Covered California launched its small business coverage in 2014, a tantalizing promise was unprecedented online account management for small businesses. Applications, enrollment management, online bill payment -- all would have leapfrogged the traditional carrier competitors in the small group market.

It took just a month for CCSB to admit they weren't ready.

Fast forward to 2019, and the traditional carriers all offer online account management, benefits enrollment, and online / automatic bill payment for small business health benefit plans. This week, CCSB finally announced the availability of online bill payments. Have you tried it? Let us know in the comments how well it works.